🔎 Google: The AI race is on!

Can the AI-first company move fast enough?

Hello there! 👋

Greetings from San Francisco!

Welcome to the new members who have joined us this week!

Join the thousands of How They Make Money subscribers receiving insights on business and investing every week.

Unless you’ve been living under a rock, you’ve heard of ChatGPT by now. It’s a state-of-the-art language generation model developed by OpenAI, capable of generating human-like text responses to various prompts.

ChatGPT was released on the last day of November and became the fastest consumer app to reach 100 million monthly average users. 👀

Following the release of ChatGPT, Google’s management has reportedly declared a “code red” akin to a fire alarm when facing a technological shift than could upend the business.

This week, Google officially revealed its own AI chatbot. It’s called Bard, and it’s powered by the company’s large language model (LaMDA).

Think of Bard as a companion to search. Google is expected to launch more products that will compete more directly with ChatGPT’s features (such as composing and constructing). But Bard is the response to ChatGPT to offer the same “wow” effect of a conversational AI in our day-to-day internet searches.

Alphabet (GOOG) (GOOGL), Google’s parent company, reported its Q4 FY22.

The recent earnings call allowed the leadership team to lay out the upcoming AI innovations (like Bard) in the race with other big tech firms.

So let’s put it all in context.

Today, we’ll cover the following:

Alphabet Q4 FY22.

Recent business highlights.

Key quotes from the earnings call.

What to watch looking forward.

1. Alphabet Q4 FY22

Income statement:

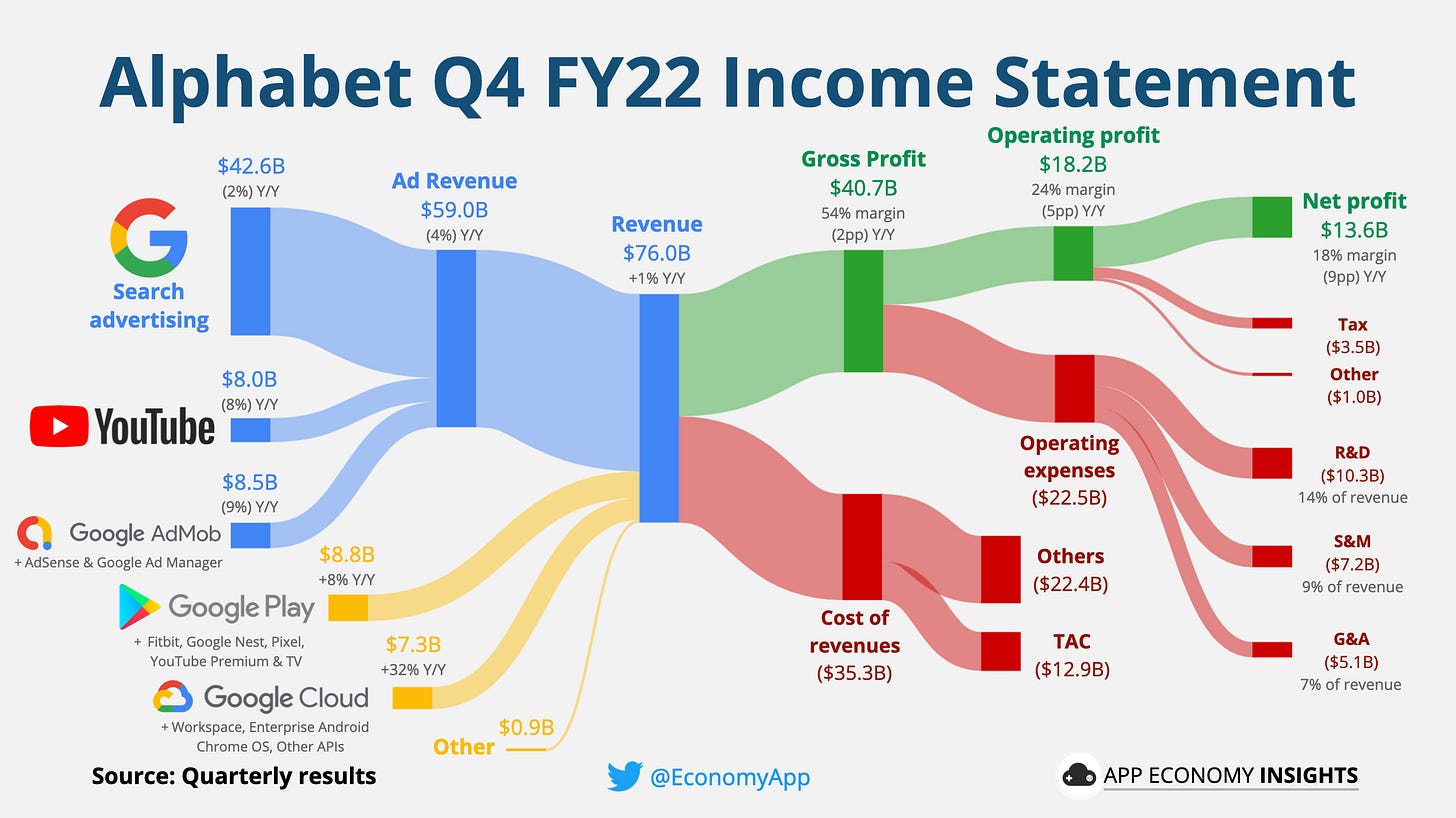

Here is a bird’s-eye view of the income statement.

Revenue by segment (growth Y/Y):

Advertising: $59.0 billion (-4% Y/Y).

Google Search: $42.6 billion (-2%).

YouTube ads: $8.0 billion (-8%).

Google Network": $8.5 billion (-9%).

Google Other (Play, Hardware, Subscriptions): $8.8 billion (+8%).

Google Cloud: $7.3 billion (+32%) (vs. +38% Y/Y in Q3).

Other Bets were $0.2 billion, and hedging gains $0.7 billion.

Main highlights:

Revenue grew +1% Y/Y to $76.0 billion or +7% fx neutral (a $0.4 billion miss).

Gross margin was 54% (-2pp Y/Y).

Operating margin was 24% (-5pp Y/Y).

Google Services (Advertising & Other) 31% (-6pp Y/Y).

Google Cloud -7% (+9pp Y/Y).

Earnings per share $1.05 ($0.14 beat).

Cash flow:

Operating cash flow was $23.6 billion (31% margin, -2pp Y/Y).

Free cash flow was $16.0 billion (21% margin, -4pp Y/Y).

Balance sheet:

Cash, cash equivalent, and marketable securities: $113.8 billion.

Long-term debt: $14.7 billion.

So what to make of all this?