⚡️ Energy Drink Economics

The cautionary tale of Celsius Holdings

Welcome to the Premium edition of How They Make Money.

Over 160,000 subscribers turn to us for business and investment insights.

In case you missed it:

US stocks have soared to new highs this year.

But not every stock is riding the wave. While companies like NVIDIA and Palantir are grabbing headlines thanks to the AI craze, let’s talk about a stock with the opposite trajectory in 2024: Celsius Holdings (CELH).

Many readers requested this one.

📉 Celsius is now trading 70% below its May 2024 peak.

Why was Celsius such a big deal in the first place? Investors were betting that Celsius could replicate the legendary success of Monster Beverage (MNST)—one of the best-performing stocks of the past 30 years. For many, it felt like a second chance to capture the exponential returns Monster delivered years ago.

So, what went wrong? Were there signs that could have warned investors during Celsius’ meteoric rise in early 2023?

To understand why Celsius’ explosive growth story fizzled, we need to break down the economics of energy drinks and uncover the risks lurking beneath the surface.

Today at a glance:

Energy drink market.

Risks and telltale signs.

How Celsius makes money.

What to watch looking forward.

1. Energy drink market

In 2024, the global energy drinks market is projected to reach $74 billion, with a CAGR of nearly 6% through 2030, according to Mordor Intelligence.

Competitive Landscape

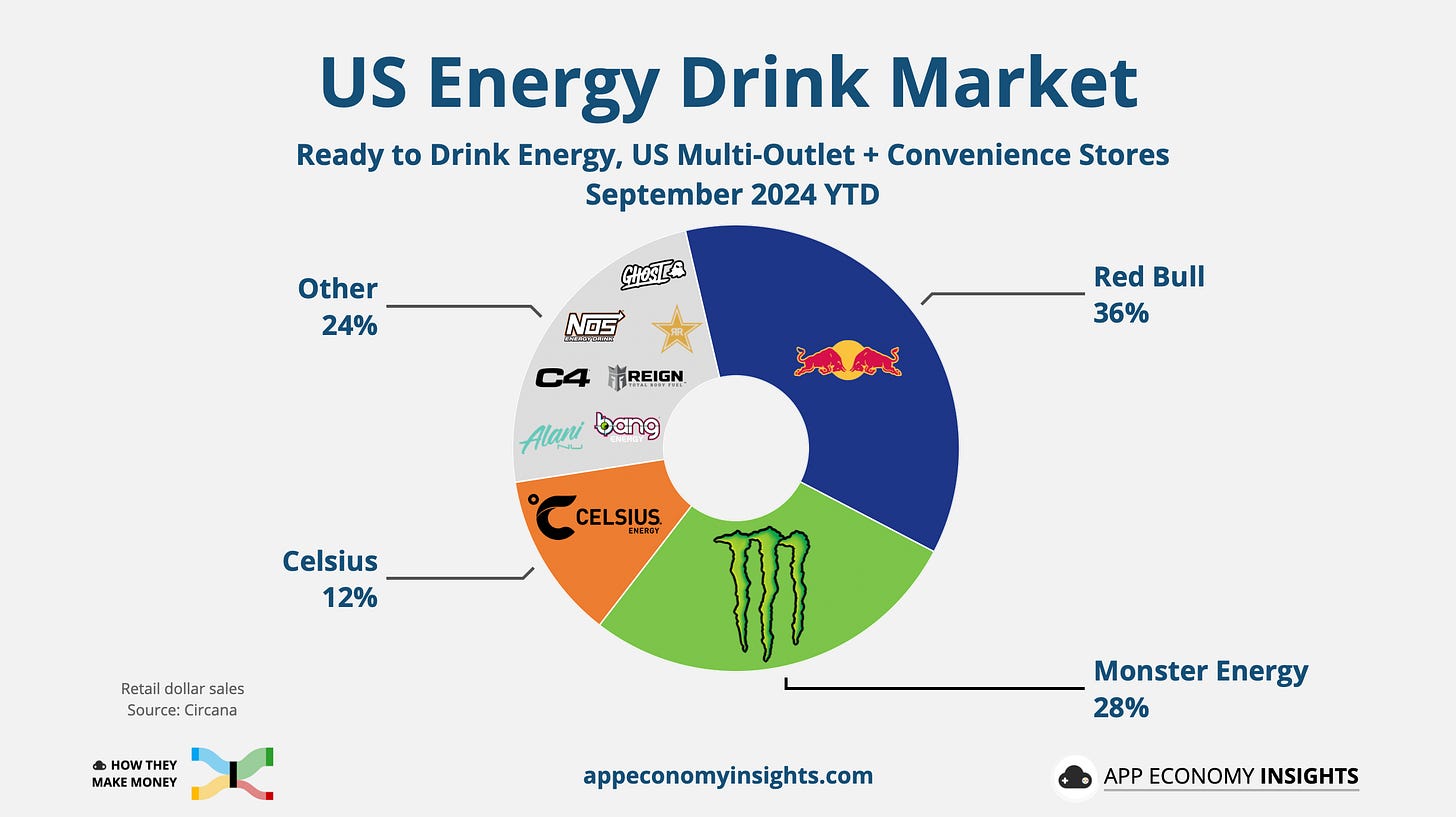

The chart below highlights the top brands by market share (data by Circana).

Celsius operates in a fiercely competitive industry dominated by global giants:

Red Bull: Credited with pioneering the energy drink category, the Austrian giant is still private. It maintains a stronghold on market share with premium positioning, accounting for 36% of the US energy drink market.

Monster Beverage: A leading public company in the category with an expanding portfolio and a significant global presence.

In 2014, Coca-Cola invested $2 billion in Monster Beverage for a 17% stake.

Monster inherited Coca-Cola’s Energy Portfolio, which included NOS, Full Throttle, Burn, Mother, and Relentless. In 2019, Monster launched Reign (3% market share today) to compete directly with Celsius.

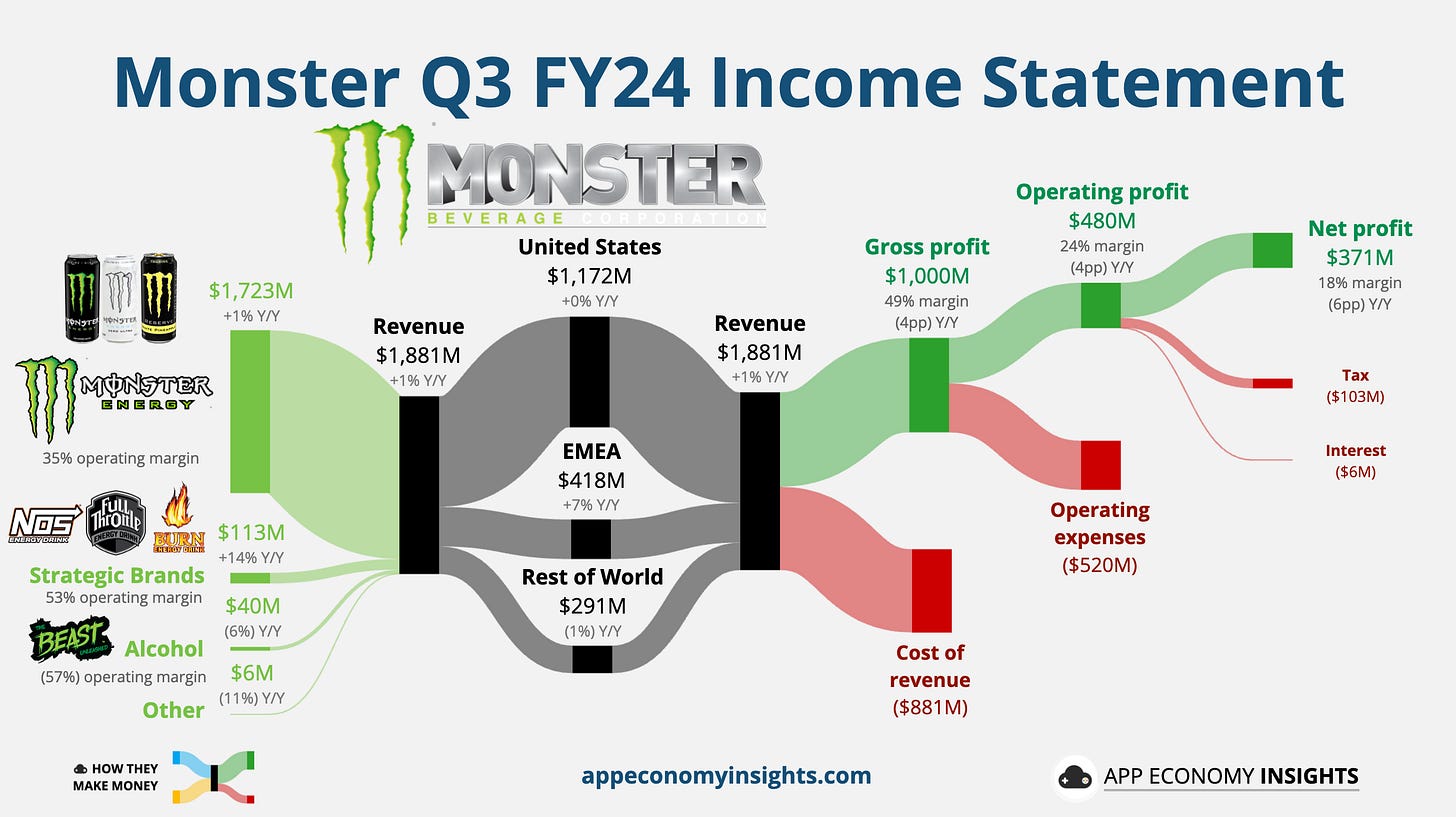

In the most recent quarter, Monster faced weaker consumer demand, with its alcohol brands underperforming. Excluding alcohol and adjusted for currency headwinds, revenue grew 5% in Q3.

PepsiCo (PEP) and Coca-Cola (KO): Both beverage giants have pursued the functional energy space aggressively: