🏅 Charlie Munger's Favorites

Buffett's investing partner passed away, but his legacy lives on

Greetings from San Francisco! 👋🏼

A warm welcome to the recent additions to our community!

Over 65,000 How They Make Money subscribers turn to us weekly for business and investment insights. Glad you're here.

Charlie Munger died peacefully on Tuesday, just shy of his 100th birthday. He was an investing legend and Warren Buffett's partner at Berkshire Hathaway.

Buffett expressed his deep appreciation in a statement:

“Berkshire Hathaway could not have been built to its present status without Charlie’s inspiration, wisdom, and participation.”

In 2015, Buffett noted how Munger profoundly impacted his investment approach:

"The blueprint he gave me was simple: 'Forget what you know about buying fair businesses at wonderful prices; instead, buy wonderful businesses at fair prices.’"

The investing community respected and adored him for his wit, quotable quotes, and mental models about business, investing, and life.

From the 2010 annual Berkshire Hathaway meeting:

"If I can be optimistic when I'm nearly dead, surely the rest of you can handle a little inflation."

Today's edition is a tribute to Munger, exploring his favorite companies and revisiting his most memorable quotes and principles.

Charlie’s favorite investments

Berkshire Hathaway

Munger was Vice Chairman at Berkshire since 1978, where his wisdom significantly shaped the company’s investment strategy. Berkshire stock accounted for most of Munger’s wealth. At his death, he owned over 4,000 shares worth more than $2 billion.

Munger influenced many of Berkshire’s key investments, reflecting his unique approach to value investing. We compiled visuals of Berkshire’s top holdings here. 👇

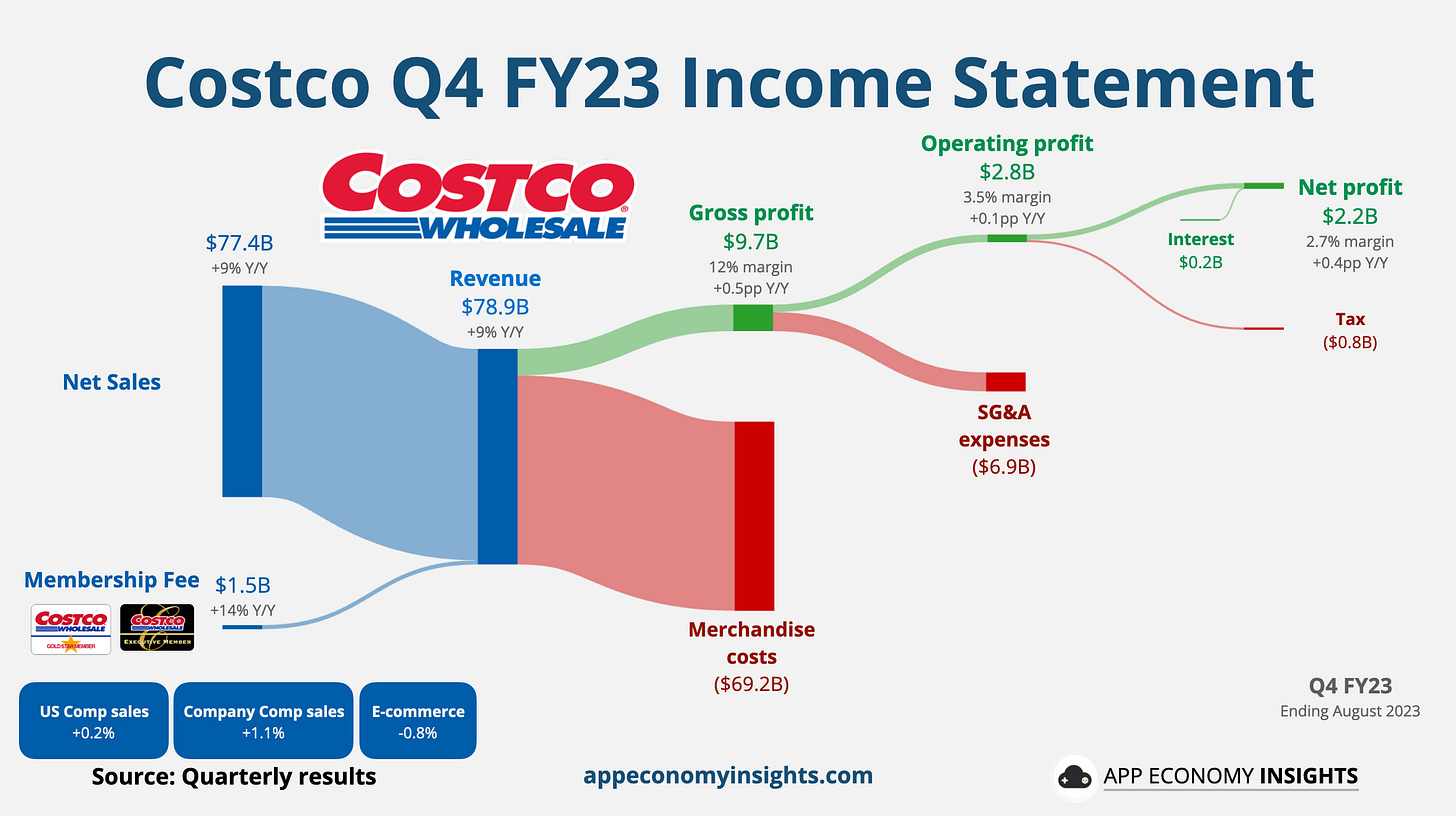

Costco

Munger served on Costco's board, often praising its compelling business model, customer loyalty, and ethical leadership. He explained in typical Munger fashion:

"I think Costco is going to be a survivor among the internet retailers. I think the people who are going to compete with Costco are going to have one hell of a time doing it. Trying to take Costco down would be like trying to take Gibraltar with a pea shooter."

Wells Fargo

Munger had a long-standing admiration for Wells Fargo, viewing it as a well-managed, reliable bank. However, Berkshire Hathaway's stake in Wells Fargo has been reduced to zero following various scandals at the bank.

Alibaba

Munger quadrupled his position in Alibaba in 2021. It didn’t work out as planned, with the stock near an all-time low at the time of this writing. Munger explained:

“I regard Alibaba as one of the worst mistakes I ever made. I got charmed by the idea of their position in the Chinese internet; I didn't stop to realize they're still a goddamn retailer. It's going to be a competitive business, the internet — it's not going to be a cakewalk for everybody.”

Mungerisms

From investment strategies to life philosophies, Munger's quotes are goldmines.

A simple formula for success

“It’s so simple. You spend less than you earn. Invest shrewdly, and avoid toxic people and toxic activities, and try and keep learning all your life, etcetera etcetera. And do a lot of deferred gratification because you prefer life that way. And if you do all those things you are almost certain to succeed. And if you don’t, you’re gonna need a lot of luck.”

Let’s dive into these ideas a bit deeper.

Learn every day

"I constantly see people rise in life who are not the smartest, sometimes not even the most diligent, but they are learning machines. They go to bed every night a little wiser than they were when they got up and boy does that help, particularly when you have a long run ahead of you."

Be ready to unlearn, too

“We all are learning, modifying, or destroying ideas all the time. Rapid destruction of your ideas when the time is right is one of the most valuable qualities you can acquire. You must force yourself to consider arguments on the other side.”

Earn the outcome

“To get what you want, you have to deserve what you want. The world is not yet a crazy enough place to reward a whole bunch of undeserving people.”

This simple idea is a recurring theme for Munger. He also likes to say the best way to find a good spouse is to “deserve a good spouse.”

Multidisciplinary thinking

"It's kind of fun to sit there and outthink people who are way smarter than you are because you've trained yourself to be more objective and more multidisciplinary. Furthermore, there is a lot of money in it, as I can testify from my own personal experience."

Munger’s approach involved drawing appropriately from multiple disciplines to think outside the box. He believes people who think broadly and integrate knowledge from diverse origins make better decisions.

Invert, always invert

“Turn a situation or problem upside down. Look at it backward.”

Inversion is a problem-solving technique that involves looking at problems backward or from the opposite perspective. Munger points out that complex problems can often be more effectively addressed by reversing the usual direction of thinking.

Envy is a stupid sin

“Envy is a really stupid sin because it's the only one you could never possibly have any fun at. There's a lot of pain and no fun. Why would you want to get on that trolley?"

Temperament matters more than brains

“People calculate too much and think too little.”

The capacity to look outside of the spreadsheet is critical for investors.

“A lot of people with high IQs are terrible investors because they’ve got terrible temperaments. And that is why we say that having a certain kind of temperament is more important than brains. You need to keep raw irrational emotion under control. You need patience and discipline and an ability to take losses and adversity without going crazy. You need an ability to not be driven crazy by extreme success.”

Incentives drive the world

"Show me the incentive and I will show you the outcome."

Incentives are a primary driver of behavior and can predict outcomes in business and personal decisions. Munger highlights the importance of always considering how incentives influence decision-making and actions. The wrong incentives can sometimes lead to unethical or destructive behavior.

Market sell-offs are part of the process

"If you're not willing to react with equanimity to a market price decline of 50% two or three times a century, you're not fit to be a common shareholder and you deserve the mediocre result you're going to get."

I’ve read this quote more than I can count during bear markets.

The big money is in the waiting

Munger has been an advocate of patience and long-term thinking in investing.

"The big money is not in the buying and selling, but in the waiting. […] It’s waiting that helps you as an investor, and a lot of people just can’t stand to wait. If you didn’t get the deferred-gratification gene, you’ve got to work very hard to overcome that.”

This is one of my favorite Munger quotes. We discussed it recently on our YouTube Channel, covering the benefits of expanding our time horizon with examples such as the Coffee Can Portfolio.

Bottom line

Munger once advised Buffett to live his life according to how he wanted his obituary written. Start with the desired outcome and work backward—another great application of the concept of inversion.

Munger’s life and teachings, encapsulated in Poor Charlie’s Almanack, will remain a guiding light for investors and thinkers alike.

That’s it for today!

Stay healthy and invest on!

Learn more about App Economy Insights directly on our website.

Apply to Sponsor Us

We're offering new sponsorship opportunities for B2B and B2C brands to get in front of our audience of investors and business leaders. Click here to learn more.

Get Your Business a Custom Chart

Interested in custom charts for your organization or brand? Complete the form here, and we'll get in touch.

Disclosure: I am long AAPL, BABA in the App Economy Portfolio. I share my ratings (BUY, SELL, or HOLD) with App Economy Portfolio members.

Author's Note (Bertrand here 👋🏼): The views and opinions expressed in this newsletter are solely my own and should not be considered financial advice or any other organization's views.

We're going to keep remembering him

Good article!

BTW, hope you can cover PDD in near future.