🎨 Adobe: Firefly, AI Tailwinds & Figma

AI opportunities abound while the Figma deal remains uncertain

Greetings from San Francisco! 👋

Welcome to the new members who have joined us this week.

Join the 38,000+ How They Make Money subscribers receiving insights on business and investing every week.

Today at a glance:

Adobe Q2 FY23 earnings.

Firefly and Sensei Generative AI.

Key quotes from the earnings call.

Future developments to keep an eye on.

At its annual conference, Summit 2023, Adobe unveiled a suite of innovations, the shining star being its new generative AI technology, Firefly.

In recognizing and harnessing the transformative power of AI, Adobe is setting a compelling precedent for the rest of the software industry. Known worldwide for its creative software solutions, including Photoshop and Illustrator, Adobe is now spearheading the next phase of creative design. Firefly places Adobe at the vanguard of generative AI, unlocking untapped possibilities for artists, designers, marketers, and beyond.

In our articles, we frequently emphasize the significance of first-party data in the rapidly growing generative AI landscape. While some models, like OpenAI’s ChatGPT, are trained on open Internet data, large Enterprise Software companies have the advantage of leveraging their own unique data sets to stay competitive (more on that in a minute).

But Adobe's ambitions extend beyond AI. The potential $20 billion acquisition of Figma—a leading design platform—looms on the horizon, promising to further consolidate Adobe's leadership in the creative industry. However, this isn't a done deal yet; potential roadblocks from antitrust regulators in the U.S. and the U.K. could throw a wrench in the works.

In this article, we'll dissect Adobe’s latest earnings call, highlighting key strategic moves, with a special focus on Firefly's impact and the pending Figma acquisition. Strap in as we dive into Adobe's unfolding story at the intersection of creativity, AI, and big-tech M&A.

But first, let's review the most recent quarter!

1. Abode Q2 FY23

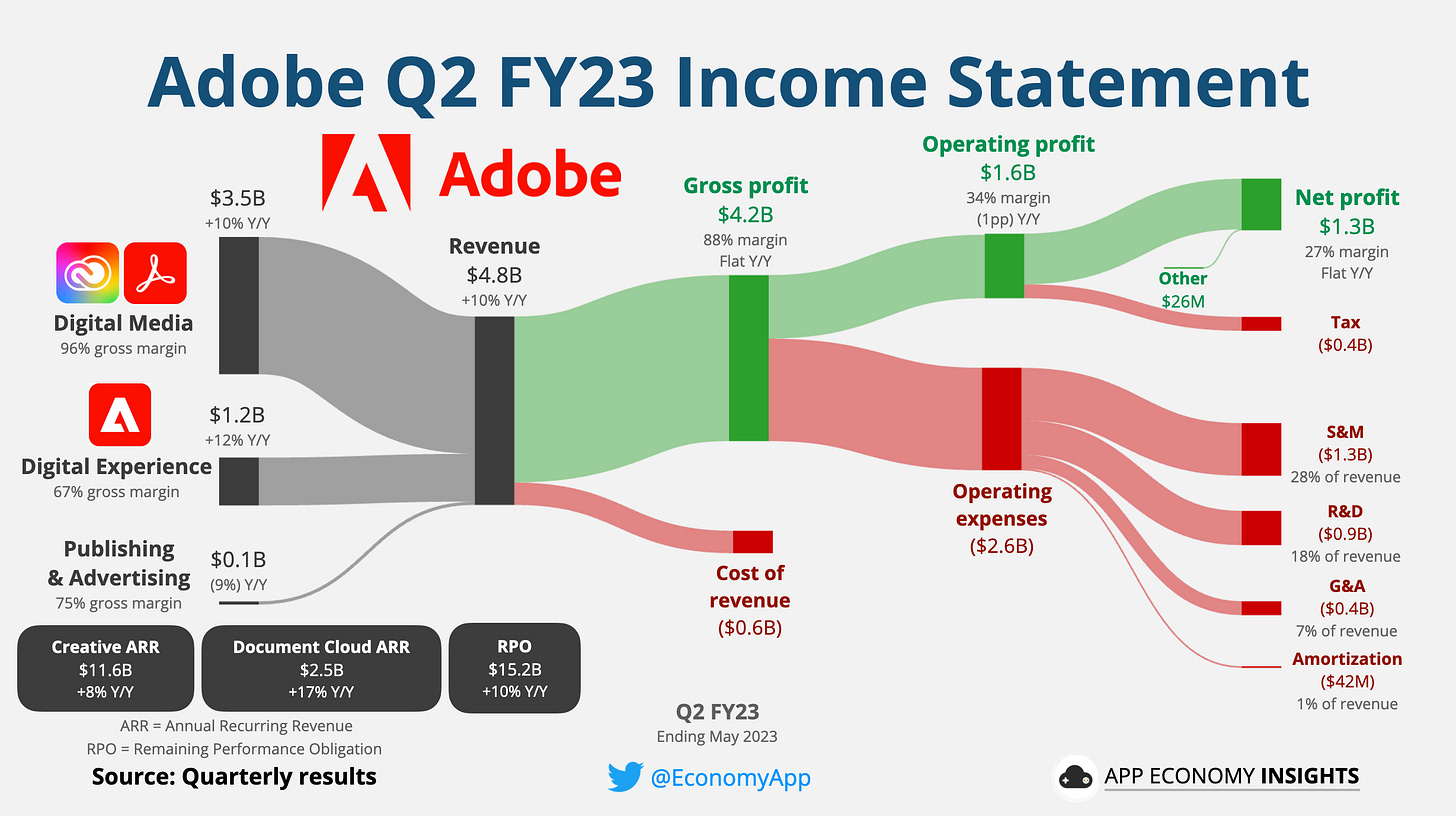

Let's unpack the earnings report for the second quarter of FY23 (ending in May).

Key metrics definition:

RPO (Remaining Performance Obligations) indicates future revenues that are under contract but not yet recognized.

ARR (Annual Recurring Revenue) indicates the total yearly value of subscription revenue. This is critical because ~93% of Adobe’s revenue comes from subscriptions.

Income statement:

Here is a bird’s-eye view of the income statement.

Revenue has three main segments:

Digital Media (73% of overall revenue).